FORMER NEXIM BANK CHIEF HANDED 490-YEAR SENTENCE IN LANDMARK FRAUD CONVICTION

By PRESSCODE NEWS

ABUJA, NIGERIA. 5TH FEBRUARY 2O26

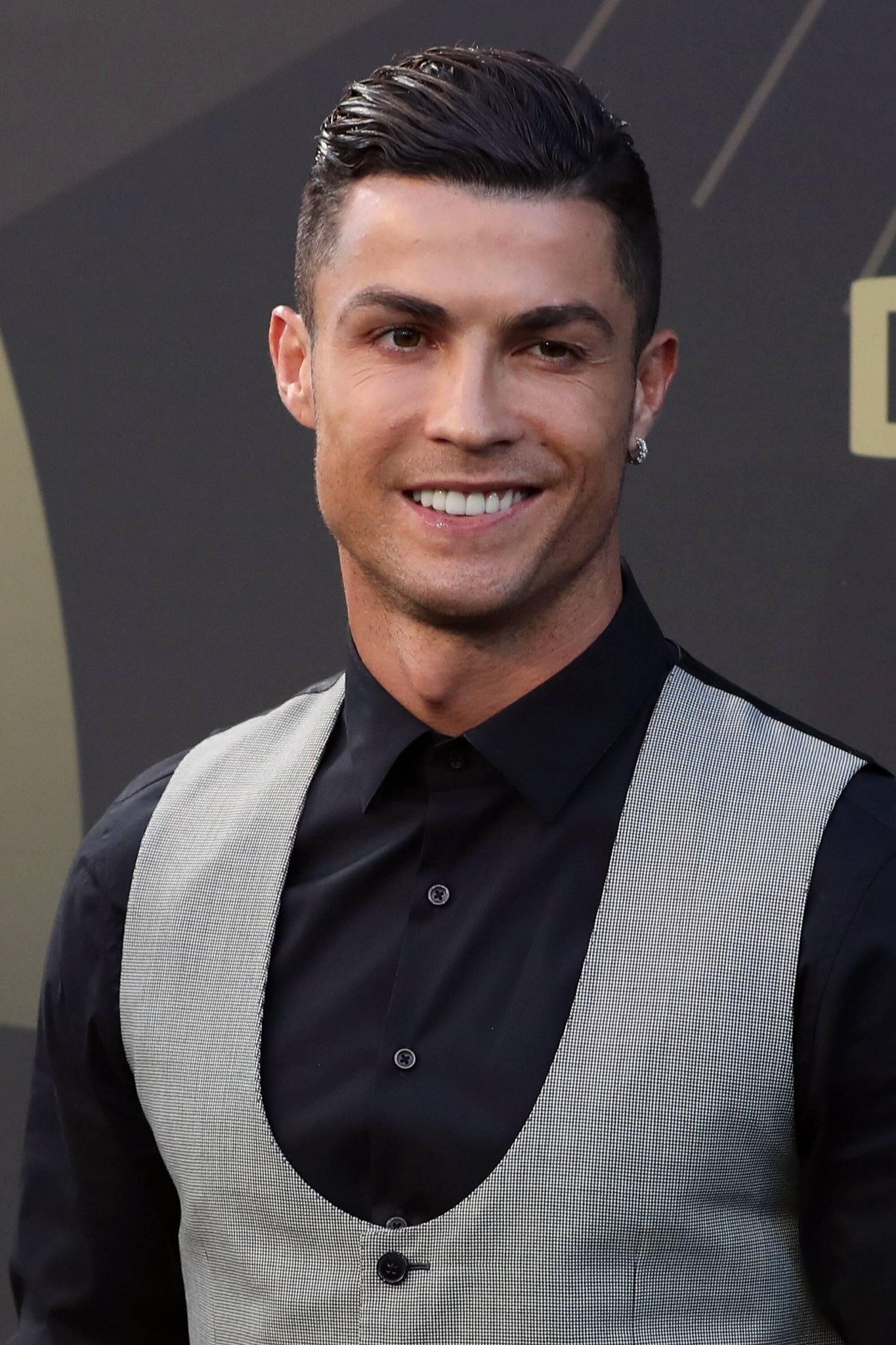

A Federal Capital Territory High Court in Abuja has delivered a historic judgment, sentencing Robert Orya, former Managing Director of the Nigeria Export-Import Bank (NEXIM), to 490 years imprisonment following his conviction on fraud charges involving ₦2.4 billion in public funds.

Justice F. E. Messiri presided over Thursday’s proceedings, finding Mr Orya guilty on all 49 counts presented by the Economic and Financial Crimes Commission (EFCC). The charges encompassed fraud, criminal breach of trust, abuse of office, and various corruption-related offences committed during his tenure at the development finance institution between 2011 and 2016.

The court imposed a 10-year custodial sentence for each count, ordering them to run consecutively to arrive at the cumulative term. The EFCC’s prosecution team, led by Samuel Ugwuegbulam, presented compelling evidence demonstrating how the former banker systematically abused his position to unlawfully obtain and misapply public funds.

According to the anti-graft agency, Mr Orya employed fictitious identities and shell companies to divert institutional resources, including loans that failed to serve any legitimate development purposes. The case,

which commenced with his arraignment in 2021, has attracted nationwide attention due to its magnitude and the severity of the penalty.

In a post-verdict statement, the EFCC described the conviction as a watershed moment in Nigeria’s fight against financial crime, emphasising that accountability extends to all public officials regardless of rank or influence.

The judgment has ignited widespread discussion on social media platforms, with analysts examining its implications for corporate governance and accountability standards within Nigeria’s financial sector.

PRESSCODE NEWS INSIGHT

This extraordinary sentence represents one of the most severe judicial responses to white-collar crime in contemporary Nigerian jurisprudence. The ruling transcends individual culpability, signalling a decisive institutional commitment to deterring financial misconduct at executive levels. For regulators, corporate boards, and senior management across the financial sector, the message is unequivocal: the integrity of public funds is non-negotiable, and breaches will attract proportionate consequences. The case underscores the vital importance of robust oversight mechanisms, transparent internal controls, and ethical leadership in safeguarding state-owned institutions from similar abuses of public trust.

PRESSCODE NEWS

The More You Know Presscodenews.com Presscodenews@gmail.com